Chris Philips

Senior Investment Analyst of Vanguard Strategy Group

Get Updates from Chris Philips

Recently I went through the process of purchasing a mapupdate for my GPS (yes, I realize there are phone apps that provide GPS directions … a discussion of my technology choices is not the focus of this particular blog!). As I was exploring the various options, I found that I could purchase global maps, regional maps, North American maps, or U.S.-only maps (as well as several variants of those basic options). Not seeing the overwhelming pros of purchasing street maps of Europe at this time, I elected to purchase only the maps of the U.S. and Canada and save some money in the process. In other words, there really wasn’t a need to diversify!

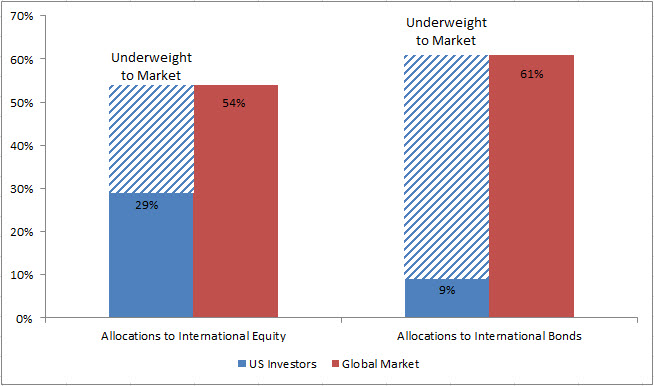

However, this got me thinking about how polar-opposite my GPS decision was to the decisions I’ve made in my own portfolio and the advice we give clients about the need to diversify globally. Specifically, we’ve done a lot of work around the question of “home bias,” or the desire to invest predominantly in your own country, and how to think about the balancing act between home bias and the benefits of investing beyond your borders. A quick review of a report put together by the International Monetary Fund (IMF) shows that as of year-end 2012 (the most recent data available), U.S. investors underweighted international equities by 25 percentage points and international fixed incomeby 52 percentage points. What the data don’t show is that many investors have much less than the aggregate values shown in the figure below.

Source: Vanguard, Thomson Reuters Data stream, Barclays, and IMF Coordinated Portfolio Investment Survey.

While a GPS unit that only shows me the streets of the U.S.and Canada may be optimal for my expected driving patterns over the foreseeable future, a portfolio that invests solely in those same countries is not. Infact, our research has shown that a portfolio that includes investments in bothU.S. and non-U.S. equities and fixed income securities has been less risky onaverage than one exposed to U.S. investments alone. While the empirical evidence bears this out, it’s really quite intuitive. As long as the investments of two countries aren’t identical in their makeup and return patterns over time, there’s an expected benefit to holding both of them. The broader and more diverse a portfolio, the less dependent it is on the returns of any one sector, style, or country. And while a year like the last one makes it difficult to contemplate diversifying the substantial returns of the U.S.,there are inevitable periods where the U.S. may be the laggard.

So is there a “right” amount of diversification? Well, that’s where it gets nuanced. Vanguard approaches this question in three steps:

- First, we strongly believe that unless there is a specific reason for not diversifying, investors are better off with both U.S.and non-U.S. equity and fixed income investments.

- Second, we believe that an upper limit on the amount of diversification should be a portfolio that reflects the same allocation as the global market. For stocks today, this would result in a portfolio approximately 50% in U.S. equities and 50% in non-U.S. equities.

- Finally, the actual allocation that each investor lands on between 0% and market-proportional should reflect a number of considerations. For Vanguard Target Retirement Funds and Life Strategy Funds, we allocate 30% of the equity investments and 20% of the fixed income investments in securities domiciled outside of the U.S.

In other words, our funds are in line with the average exposure of U.S. investors on the equity side, and slightly more than double the average exposure on the fixed income side. Within those allocations, we reflect the weights of each country and region proportionally. Of course, while these figures represent a reasonable guide, each individual should consider whether these allocations are right for them. While we all can benefit from diversification, there is no optimal allocation for all investors.

Blog by: Chris Philips, Senior Investment Analyst ofVanguard Strategy Group.

© 2014 The Vanguard Group, Inc. All rights reserved. Usedwith permission.